Aaj Ka Stock Market: Kya Ho Raha Hai?

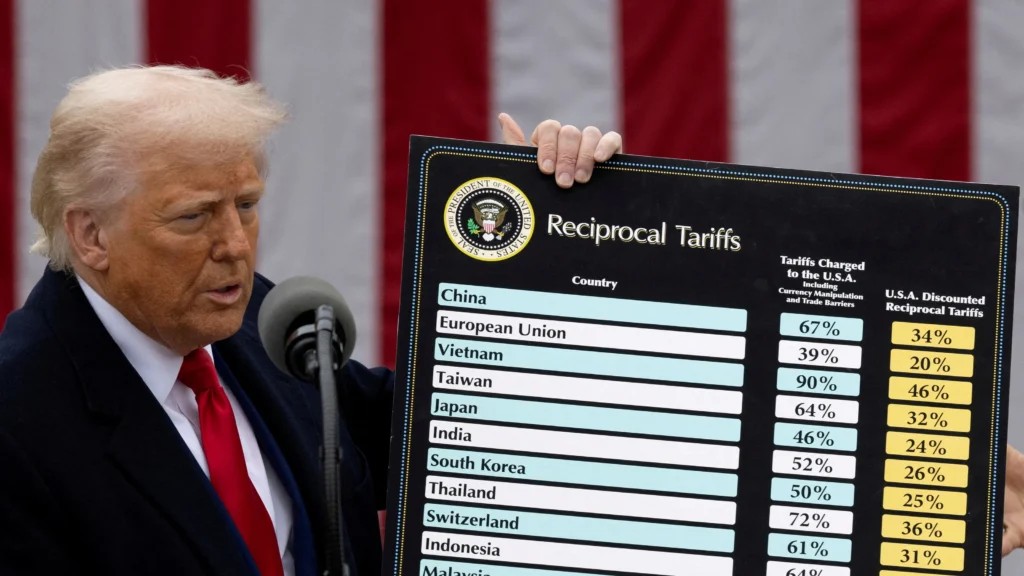

Aaj ka din Indian share market ke liye bahut hi stressful shuruat le kar aaya hai. US President Donald Trump ne kal raat ko ek unexpected move kiya – 25% import tariff on Indian goods. Iske turant baad hi GIFT Nifty me sharp fall dekhne ko mila, aur ab Sensex & Nifty 50 me bhi gap-down opening expected hai.

Kya Bola Donald Trump Ne?

Donald Trump ne bola:

“India ne unfair trade practices follow kiye hain, aur hume apne manufacturers ko protect karna hoga.”

Ye announcement ek sudden blow tha Indian exports ke liye, especially steel, pharma, auto components, aur textiles industries.

GIFT Nifty Trends Kya Bata Rahe Hain?

GIFT Nifty ne early morning me hi signal de diya tha ki market crash hone wala hai:

- GIFT Nifty Down ~250 points

- Global cues negative hain

- Asian markets bhi red zone me trade kar rahe hain

Ye sab indicate karta hai ki market me panic mode shuru ho chuka hai.

Sensex Aur Nifty 50 Me Kitni Girawat?

- Sensex expected to fall by 500+ points

- Nifty 50 ne support zone 21,850 tod diya hai

- Intraday charts bearish lag rahe hain

Aaj Ki Opening:

| Index | Open | Low | Trend |

|---|---|---|---|

| Sensex | -540 pts | -620 pts | Bearish |

| Nifty 50 | -150 pts | -180 pts | Bearish |

Kis Sector Pe Sabse Zyada Impact?

| Sector | Trend | Kyu Impacted? |

| Auto | ❌ Negative | US Export Duty |

| Steel/Metal | ❌ Negative | Direct Impact From Tariffs |

| Pharma | ❓ Mixed | Global Demand Stable |

| FMCG | ✅ Positive | Safe Haven Sector |

Investor Sentiment Aur FIIs

Foreign Institutional Investors (FIIs) ne bhi selling start kar di hai:

- USD/INR ka rate 83.10 cross kar gaya hai

- Crude oil prices upar ja rahe hain

- VIX (Volatility Index) spike hua hai – sign of fear

Ye sab indicators batate hain ki market me abhi high risk zone chalu ho gaya hai.

Expert Opinions

Motilal Oswal:

“Short-term correction expected hai. Par long-term investors panic na karein.”

Zerodha Varsity:

“Market reaction overdone lag raha hai. Buying opportunities bhi milengi.”

Traders Aur Investors Kya Karein?

For Traders:

- Short positions banayein in Auto, Steel

- Tight stop-loss lagayein

- Avoid leveraged trades

For Long-Term Investors:

- Panic selling na karein

- SIP continue rakhein

- Quality stocks (ITC, HUL, Infosys) pe dhyan dein

Stock Picks Aaj Ke Liye

| Stock | Action | Reason |

| HDFC Bank | Buy on Dips | Strong fundamentals |

| Tata Steel | Avoid | Tariff impact |

| Infosys | Hold | Defensive IT stock |

| ITC | Accumulate | Safe haven, low volatility |

Global Market Impact

- Dow Jones ❌ Down ~1.2%

- Nasdaq ❌ Down ~0.9%

- Nikkei ❌ Red

- Hang Seng ❌ Red

US-India tension ka global supply chain par asar pad sakta hai. Isliye aaj safe trading zaroori hai.

IN&gl=IN&ceid=Ihttps://news.google.com/topics/CAAqJggKIiBDQkFTRWdvSUwyMHZNRFZxYUdjU0FtVnVHZ0pWVXlnQVAB?hl=en-IN&gl=IN&ceid=IN:enN:en

NSDL IPO Day 1: Paisa Kamaane Ka Ultimate Mauka !

FAQs

Q.1 Stock market me girawat ka reason kya hai?

US ne India par 25% tariffs laga diye hain, jisse global investors ne sell-off start kar diya.

Q.2 Kya ye correction long-term hoga?

Analysts keh rahe hain ye ek short-term panic reaction hai.

Q.3 Kaunse stocks safe hain abhi?

FMCG aur Pharma jaise sectors relatively safe hain.

Final Thoughts

Aaj ka stock market session ek bade geopolitical announcement ka asar hai. Trump ka tariff shock short-term volatility create karega, par ye bhi ek opportunity hai sahi stocks me entry lene ki. Long-term investors ko darne ki zarurat nahi hai, bas quality stocks me bane rahiye.

Stay calm. Trade wisely. Invest smartly.